|

On Friday, Slate had an article, which you can read here, by Zachary Kalabell, titled “Stop Obsessing Over Exorbitant CEO Pay” Because, after all, "exorbitant" apparently doesn't mean what you or the dictionary think it does ("Greatly exceeding bounds of reason or moderation"). And CEOs who are paid greatly beyond the bounds of reason in fact deserve our sympathy and a hug. I’m not even remotely an expert on the subject, unlike my friend Nell Minow who travels the world lecturing on this subject, and even I found the article idiotic. That Mr. Taylor is described as a money manager turns out to not come as a huge shock. In fairness, maybe he's done a lot of study and research on the subject. But mainly, he picks and chooses random quotes that support his position from a career of managing other people's money. Almost from the start, the author contradicts himself, mentioning studies that support the problem of exorbitant CEO pay, but then he blithely dismisses all of them as meaningless in order to focus on...two studies. And of course the two studies he does like (compared to all the many mean and nasty studies he chooses to ignore in a mere sentence without going into any detail) say there’s no problem. Making this even more off-putting is that the second of the studies he likes doesn’t even say that precisely, but says only that there isn’t enough evidence to say for absolute certain there’s a problem, though there could be. Some support, eh, from half your "evidence." He tends to do that sort of thing throughout the article. For instance, he spends two paragraphs referencing an article in the New York Times critical of exorbitant CEO pay and even quotes an author who says, "The system is pretty much out of control in many ways” -- and himself adds, "That may be true" and writes another paragraph explaining why so. Yet then in a bizarre act of legerdemain, he ignores all of that and writes, "But does the widening gap between the pay of those at the top of the wealth heap and the rest actually harm those who are struggling or sinking?" Worse though is that after making this sharp U-turn, ignoring everything he's written, his focus on the problem (which he says everyone is obsessed about) is off-base. It’s never struck me that the problem is what he tries to make it: that if CEOs don’t have exorbitant pay, we can use that money by redistributing it to help the poor. That's a general argument used about income taxes, not paying CEOs beyond the bounds of reason. What’s always struck me as the issue of exorbitant CEO pay (from what I've read by people who study such things) is that it's, in fact, perfectly fine for CEOs to make huge amounts if their companies’ performance dictate it -- but when a company does poorly yet the CEO still makes massive bonuses "beyond the bounds of reason", it's that which actually hurts the company and in turn hurts the economy. Being paid exorbitant bonuses for failing is the problem. Not that people who succeed didn't help the needy enough. Furthermore, it also strikes me that the issue has never been redistributing exorbitant CEO pay to the destitute, as Mr. Karabell tries to make it, but rather that when so many tens of millions of dollars in a single company are being siphoned away from the mid-range executives and employees of that company -- paid to just one executive who actually did a poor job -- you’re weakening the buying power of the middle class which again hurts the economy. The issue of exorbitant pay to failed CEOs isn't about helping the poor, but for a company to use its resources to a) help the company, and b) help shore up its middle class, which is disappearing. Even Henry Ford knew it was important that his employees could afford to buy his company's products. That supports the middle class, which is what keeps the economy strong. Mind you, all that's just my own non-scholarly opinion. For all I know, I was way off-base. So, I sent a note to Nell Minow with a link to the article. As I've mentioned, Nell is the co-founder of the Corporate Library (now GMI) which is a major organization on corporate governance. She's testified before Congress, was named one of the 20 most influential people in corporate governance by Directorship magazine in 2007, was called “the queen of good corporate governance” by BusinessWeek Online in 2003, and recently received Lifetime Achievement award from the International Corporate Governance Network. The point is, she knows more about these things than I do. Happily, she not only agreed with everything I wrote, but added her own 2-cents. (Worth $1,000 when adjusted on the CEO pay scale, though her value is anything but exorbitant.) What she wrote back was -- CEO pay, like any other asset allocation made by a corporation, from marketing to operations, has to be evaluated in terms of return on investment, and in too many cases the ROI on CEO pay packages ranks lower than a piggy bank. If these outrageous pay packages actually produced better results, I would support them. If they reflected an arms' length, free market negotiation, I would support them. But the numbers show the contrary. If we pay people for poor performance, we get poor performance. And if we let executives select and control the information for the board members who set their pay, those directors will continue to support compensation that is inversely related to performance. 85% of the non-executive Oracle shareholders have twice voted against the pay of Larry Ellison, who made $96 million in 2011 and $77 million in 2012. But boards are permitted to ignore shareholder votes on pay, and that is what Ellison's board has done. If Ellison is not sufficiently motivated by his 25% of Oracle stock, worth some $46 billion, then paying him at this level will not make a difference. This is not class warfare. It is capitalism, which is being destroyed by this wholesale diversion of shareholder assets to the pockets of a few executives. The only financial benefit of these gargantuan pay packages is letting savvy investors know which stocks to short. So there.

0 Comments

Leave a Reply. |

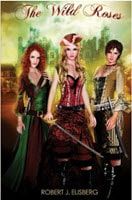

AuthorRobert J. Elisberg is a political commentator, screenwriter, novelist, tech writer and also some other things that I just tend to keep forgetting. Feedspot Badge of Honor

Archives

June 2024

Categories

All

|

|

© Copyright Robert J. Elisberg 2024

|

RSS Feed

RSS Feed